.webp)

Nonprofit Accelerator

The mentorship-driven Nonprofit Accelerator program equips top ventures as they seek the redemptive edge in their industries; each selected organization also receives a $50K unrestricted grant. We accept up to 12 startups per year, with up to two Fellows per venture.

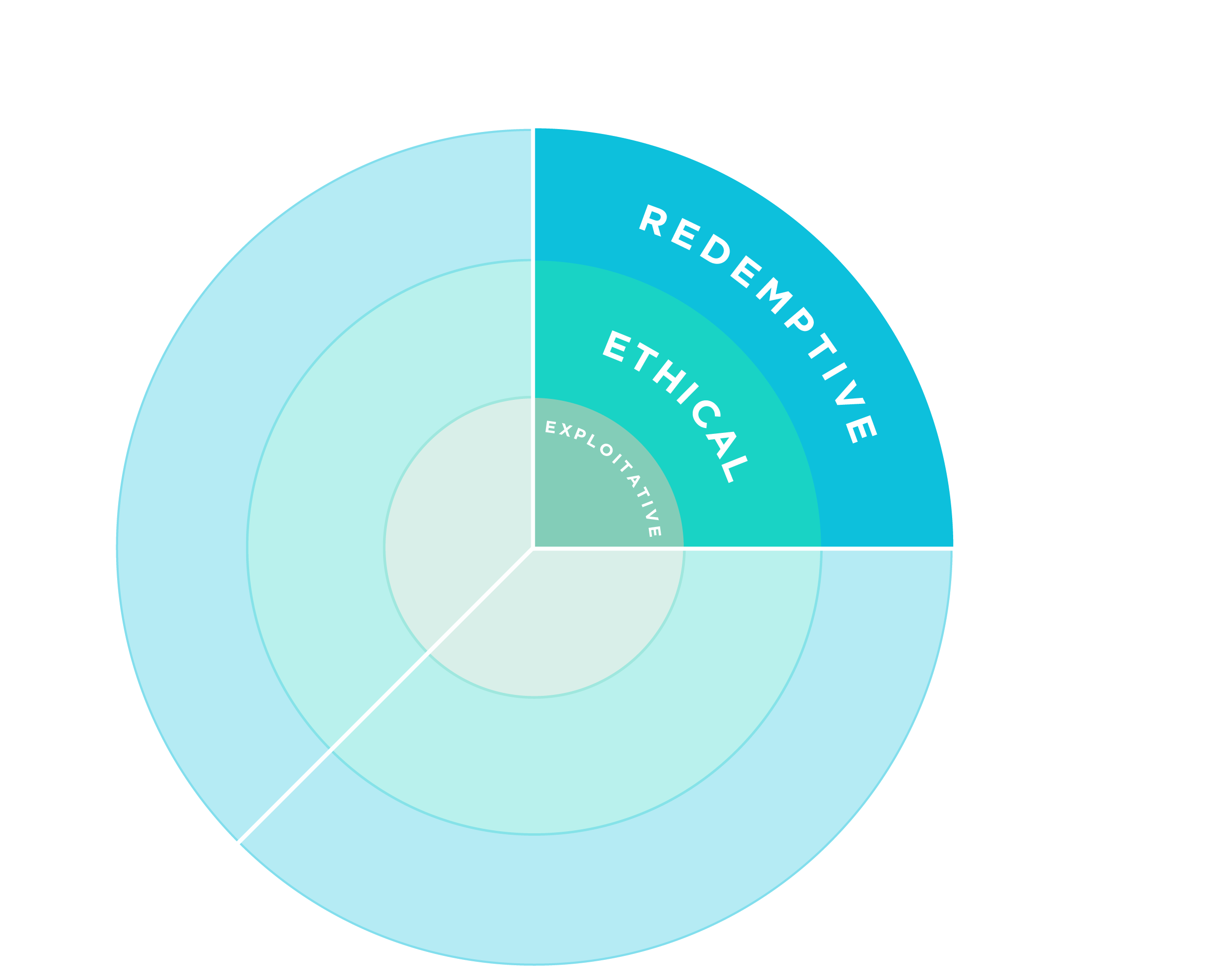

learn moreBusiness Accelerator

The mentorship-driven Business Accelerator program equips top ventures as they seek the redemptive edge in their industries; each selected organization can opt in to $100K in guaranteed investment capital. We accept up to 12 startups per year, with up to two Fellows per venture.

learn morePraxis Studio

The Praxis Studio is home to Entrepreneurs-in-Residence building their next venture, hosting regular Studio Sessions at our NYC headquarters where Praxis community members think, build, and create together at venture inflection points.

learn moreCapital Fellowship

The Praxis Capital Fellowship supports investors and philanthropists and aims to create a community of peers that build together over the long-term, joining in the work of redemptive entrepreneurship through the growth of their own vocations and the thoughtful allocation of capital.

learn morePraxis Academy

Praxis Academy is a launchpad for redemptive entrepreneurship, serving venture builders with events and resources showcasing our community, Portfolio, and content developed over a decade of formative gatherings and thought leadership.

learn more

Impact

Praxis Journal

The ideas, models, practices, and people powering today’s redemptive ventures.

Get the latest from Praxis

playbooks

Resources for building redemptive ventures.

The Praxis Playbooks are print and digital resources that offer our take on how to do redemptive work in the entrepreneurial environment.

.webp)

.webp)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)